- Pioneers by Multimodal

- Posts

- What Winning Lending Teams Know

What Winning Lending Teams Know

The patterns separating lenders who scale from those who stall in the next cycle.

AI Point Solutions vs. Platforms: Making the Right Call

Most financial services teams start their AI journey with a point solution: one tool for one job (document intake, chat, fraud flags, KYC checks). It’s the fastest way to pilot, and it often works at first.

The problem shows up when you try to scale across workflows: every new use case adds another vendor, another integration, another set of permissions, and another audit trail to reconcile.

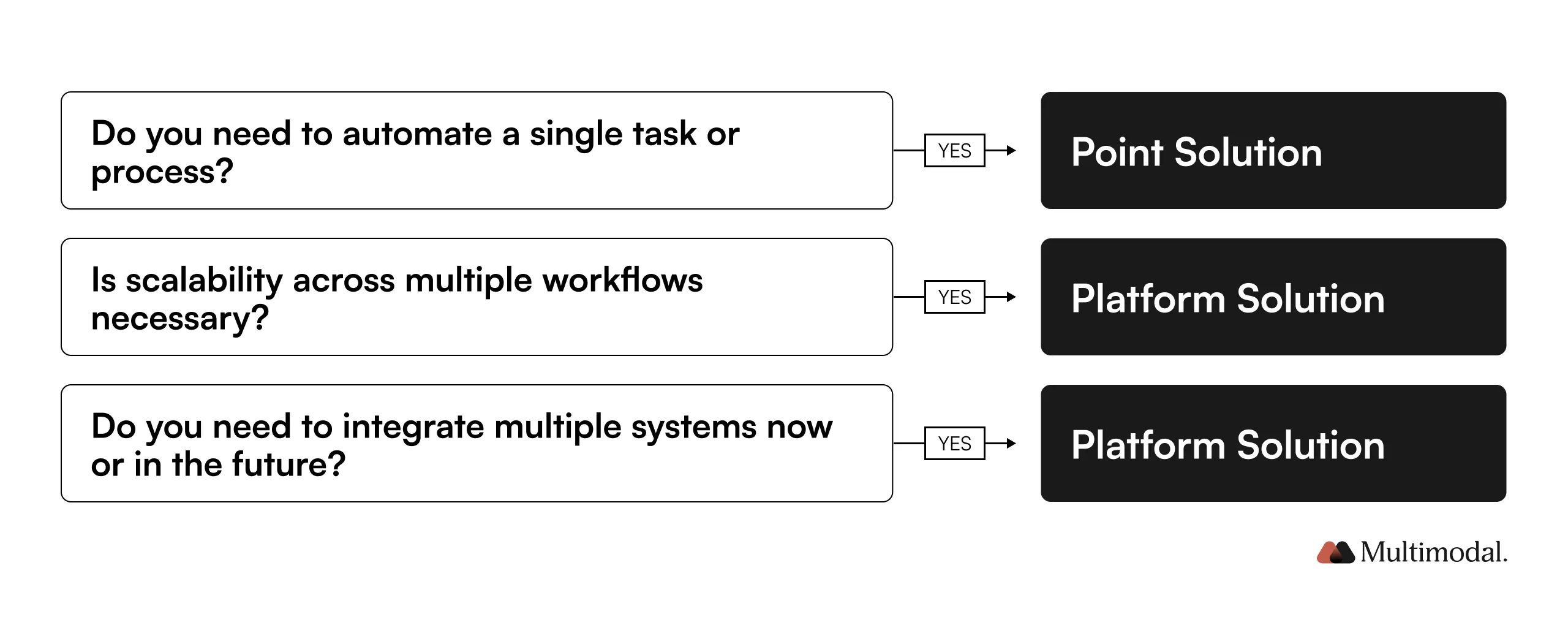

But what’s the real difference between AI point solutions and AI platforms, and how to choose based on your operating model, risk posture, and timeline?

We went deep to help you learn when a point tool is the right move, when it creates long-term fragmentation, and why platforms win when workflows span systems, teams, approvals, exceptions, and compliance requirements.

If you’re making a build vs. buy decision, mapping your AI roadmap, or trying to avoid “vendor sprawl,” this is a useful read.

Our Partnership With Filene: Advancing Agentic AI in Credit Unions

We’re partnering with Filene to help credit unions explore how agentic AI can improve operations and member experiences. Through hands-on discovery, education, and real-world demonstrations, this initiative is designed to move beyond theory and into practical implementation.

The program focuses on identifying high-value use cases, co-designing proofs of concept, assessing organizational readiness, and building clear ROI frameworks, all within a vendor-agnostic, collaborative environment.

The goal is simple: help credit unions understand where agentic AI fits, what it can realistically deliver, and how to adopt it responsibly.

Want to learn how this initiative is shaping the future of AI in credit unions?

Live Today: Agentic AI for Lending | Last Chance to Join!

When rates ease and volume spikes, the question isn’t whether demand returns, it’s whether your underwriting operation can absorb it without backlogs, burnout, or missed deals. Hiring aggressively is expensive, overtime isn’t sustainable, and manual document review doesn’t scale when volume hits.

That’s why we’re hosting a live 60-minute webinar today (Feb 18th) at 4 pm ET on how agentic AI can support underwriting, document review, and credit decisioning in real lending environments.

This is a practical session: where AI reduces friction in the workflow, what to look for in lender-built solutions, how institutions go live in weeks (not quarters), and what a realistic first AI workflow looks like.

You’ll hear from me alongside Melissa Pederson, Thomas Shaw, and Erin Schmidt as we break down what’s working in the market right now.

Last chance to register and grab a seat: