- Pioneers by Multimodal

- Posts

- What's New with AI in Banking and Business

What's New with AI in Banking and Business

Learn how AI Agents are changing business workflows and check out our new banking AI solutions.

Many changes are happening across AI, business, and finance, offering business leaders a unique opportunity to learn from global developments and their peers.

Here are some of the recent news we’re keeping an eye on:

90% of financial institutions in India are focusing on AI and Gen AI for innovation. The use of AI in finance is ’rapidly evolving’ in the US, too, but might be stifled by a lack of clarity around the necessary infrastructure and governance. ⚡ We are in for a high-stakes ‘AI arms’ race, and the winners will be those who go beyond the surface and master the complexities of AI implementation first.

FOMO is currently largely driving increasing investments in AI. However, many emphasize that real ‘workforce transformation’ can’t happen without strategic planning. ⚡ Creating a custom Generative AI strategy must precede implementation.

Australia is following the lead and plans to release voluntarily-for-now AI rules. At the same time, tech giants are protesting against ‘Europe’s bureaucratic approach to AI regulation.’ ⚡ Staying in the loop with ever-evolving AI regulations will be critical, especially for finance organizations. Companies should partner with AI experts focused on their industry for guidance.

Take our poll

We’ll share the final results with you next week.

Is your company already investing in AI? |

Introducing: Multimodal’s New Banking AI Solutions

In other news, we have just released five new AI solutions for banking. They are all powered by configured Generative AI Agents and controlled through our central platform, Mainframe.

Retail Banking

Streamline mortgage origination & underwriting, KYB and KYC processes, and fraud detection and prevention.

Commercial Banking

Automate corporate lending, trade finance, and cash management.

Financial Services

Enhance research and analysis, client relationship management, algorithmic trading, and regulatory compliance.

Credit Rating Agencies

Automate finance tasks like data collection and analysis, rating dissemination, sentiment analysis, and continuous model monitoring.

Payments Automation

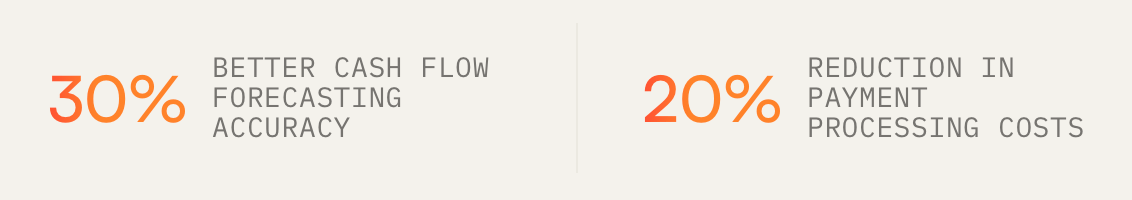

Streamline customer onboarding, dispute resolution, real-time fraud detection, and personalized reward disbursement.

Interested in learning more and deciding if we’re the right fit? Book a free demo with our experts.