- Pioneers by Multimodal

- Posts

- How Banks and Insurers Can Trust AI Faster

How Banks and Insurers Can Trust AI Faster

Skip the pilot purgatory. Deploy AI that’s built for compliance and scale.

Have you ever wanted to quickly test agentic workflows?

To check if AI agents can actually deliver the results you need, and whether your team can work effectively with them?

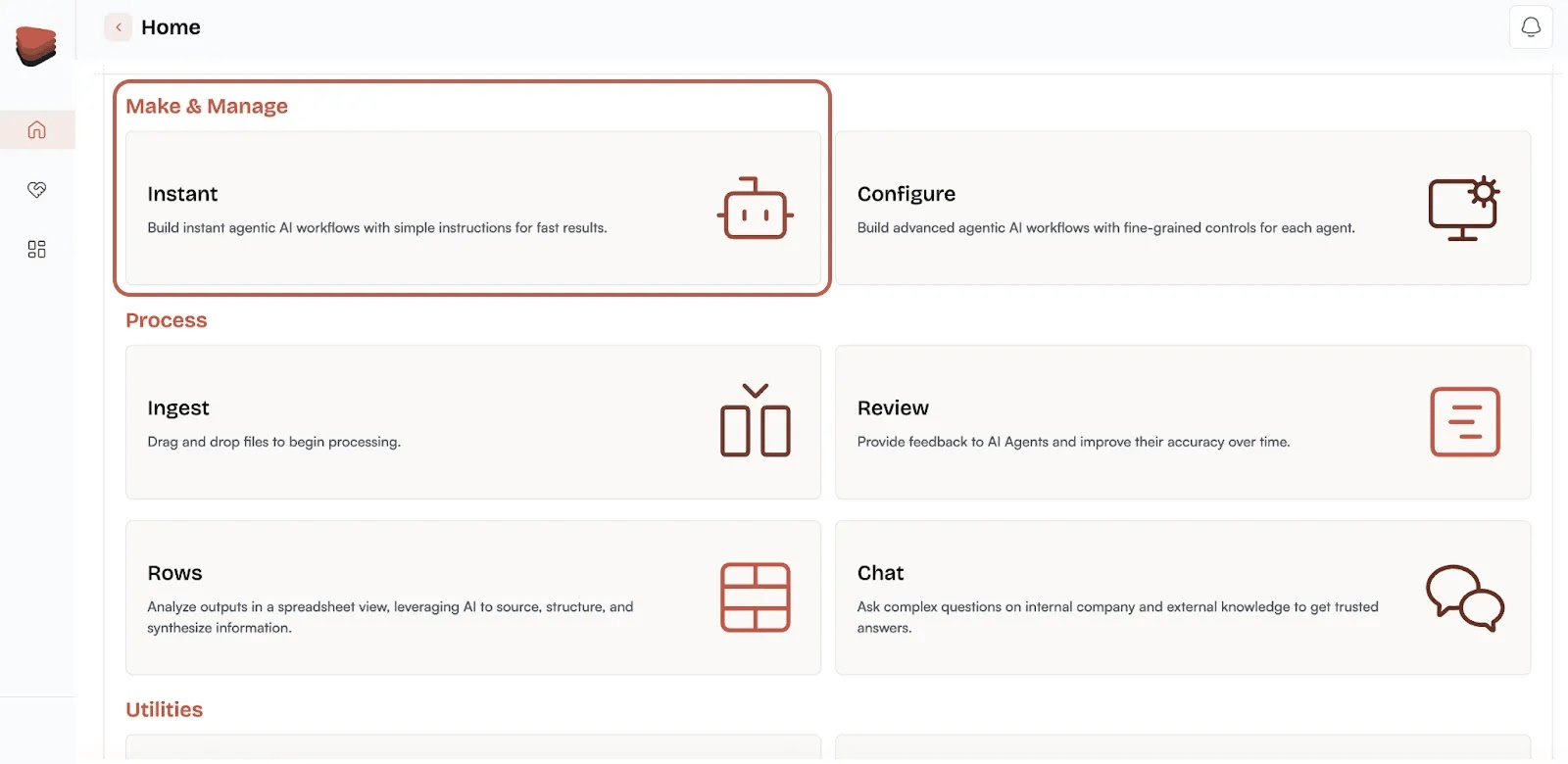

Now you can, thanks to Instant.

Instant, our new workflow builder, lets you rapidly unify multiple AI agents, build pilots, and stress-test agentic workflows under real conditions.

Discover how it helps you de-risk innovation and validate use cases in mere minutes:

Why has commercial fleet insurance stayed unprofitable for decades, even with all the data carriers have?

What happens when telematics and agentic AI start powering underwriting, turning static spreadsheets into dynamic, context-rich risk models?

Felix Kuhlmann, co-founder of Draivn and Insurance Executive-in-Residence at Accenture’s FinTech Innovation Lab, shares how AI is reshaping fleet insurance—from risk pricing to underwriting support.

We covered:

Why traditional fleet insurance pricing remains broken and unprofitable

How telematics and agentic AI unlock more accurate, contextual underwriting

The two roles AI agents can play: automation and co-pilot augmentation

Why clean, structured data pipelines are essential for trustworthy AI

Felix’s advice for fleets and carriers embracing AI-driven insurance

Jamie Clisham, VP of Data and Analytics at Machias Savings Bank, will explore how AI is helping her team streamline workflows, covering onboarding, KYC/AML, lending, and customer service, without losing compliance or the personal touch.

You’ll also get practical tips on evaluating AI vendors in regulated environments and hear real-world insights from community bank leaders who are making AI work today.

Join us live and see actionable ideas you can put into practice immediately.

Register below to catch it live: